La Orden de Ayala, productos esotéricos y exotéricos|Taller de Tarot en Exclusiva con Marianne Costa. “El Tarot y la Sagrada familia” Grabado. 25 euros

Moneda de plata del zodiaco de doce constelaciones, Tarot Virgo, dios del sol, medallas de amor de la suerte, recuerdo de astrología Euro| | - AliExpress

TAROT BARATO A SOLO 6 EUROS Las Manchas » EstoHay.com: revista digital, anuncios gratuitos, inmobiliaria, empleo, ventas y mucho mas...

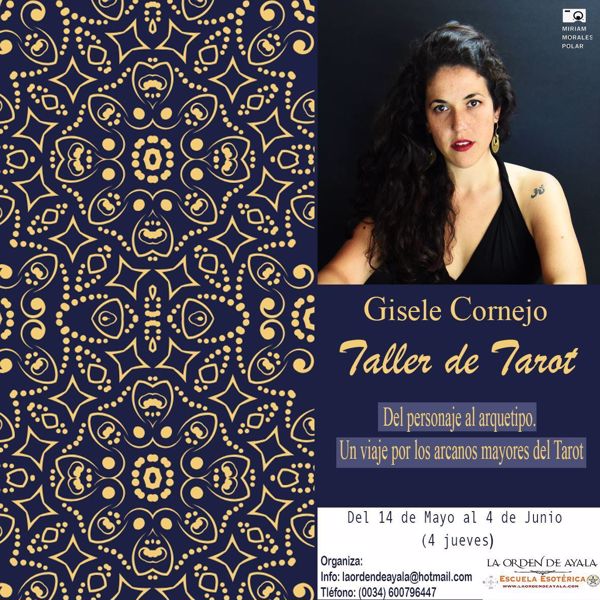

La Orden de Ayala, productos esotéricos y exotéricos|Taller de Tarot con Gisele Cornejo. (arcanos mayores) 25 euros. 8 horas grabadas.

Tarot 10 euros sin límite de tiempo: ¿Es fiable un tarot súper barato por 10 euros sin límite de tie

Monedas de euro en la carta del Tarot 'death', la destrucción, la corrupción, la imagen simbólica de la disolución de la Unión Monetaria Europea Fotografía de stock - Alamy

zcyg Tapices de Pared Tapestries Tapices, Euro Americano Tarot Astrología Salón Dormitorio Tapiz Manta tapices Arte de decoración de Interior (Color : A, Size : 150 * 130cm) : Amazon.es: Hogar y cocina

Tarot Flor de Noche - Gran promoción de otoño. Llévate con tu consulta de media hora 5 minutos gratis. 1 Euro el minuto, 15 minutos 15 euros, 35 minutos 30 euros. Tarotista -

Consulta de tarot y videntes 10 minutos 3 euros/ tarot 806 Santa Cruz de Tenerife » EstoHay.com: revista digital, anuncios gratuitos, inmobiliaria, empleo, ventas y mucho mas...

Los tarotistas 'streamers' copan YouTube: 150.000 euros al año con los 'superchats' | Business Insider España

:format(jpg)/f.elconfidencial.com%2Foriginal%2Ffdd%2F984%2Ffe7%2Ffdd984fe7a6c0248f31ff28170f88438.jpg)